On an underlying basis, Cash Converters have reported solid results for FY16, despite being impacted by restructure costs and provisioning. FY17 guidance was provided and their 19 September 2018 fixed rate note, while relatively short dated with a high margin, appears fair value given the uncertainties

Cash converters (CCV) will reduce its exposure to the lower end of the short amount credit contracts (SACC) segment. This sector generally involves people who are on low incomes and Centrelink payments, and attracts a lot of reputational issues while being subject to potential changing regulation

Cash converters (CCV) will reduce its exposure to the lower end of the short amount credit contracts (SACC) segment. This sector generally involves people who are on low incomes and Centrelink payments, and attracts a lot of reputational issues while being subject to potential changing regulation- We believe that this will have a material impact on short term revenues and profit, and relates to about one third of lending volumes. However as loan volumes fall, so does CCV’s funding requirements and interest costs

- To offset this, CCV will transition into higher loan amounts to employed people on higher incomes. CCV will launch a new loan product in November 2016, referred to as medium amount credit contracts (MACC) with the loans ranging in value from $2,000 to $5,000. We believe the new product can be managed by CCV’s existing systems

- Managing Director Peter Cumins explains as follows: “There will be a reduction in the number of loans we will write but we are prepared to wear that because in the longer term we will be better positioned with a sustainable business that doesn’t come under the same scrutiny reputationally. We will still do SACC loans but it will be a customer who has got a job ... they’ve come in eyes wide open and nobody can say they didn’t understand what they were doing”

- In Australia, loss making Carboodle has been closed and Green Light Auto Finance started. The focus of the business is to provide secured loan products rather than a complete car package. The book is $3m and is expected to grow at circa $1m per month

- CCV will also seek to add more corporate and franchise stores in New Zealand

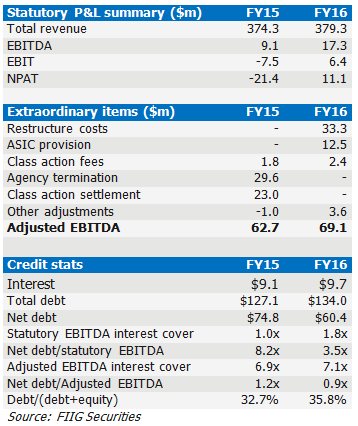

- FY16 was impacted by various extraordinary items. The bulk of the $33m restructuring costs were associated with closure of stores in the UK. $12.5m related to an ASIC provision and $6m was due to legal fees and other adjustments

- In the UK, the Company has exited its corporate owned stores and is operating as the master franchisor. It is also winding down the UK personal loan book and expects to have that closed by November 2016. CCV expects to return to profit in the UK in FY17

- The company expects these other initiatives to offset the fall in lending volume in around three years

CCV forecasts FY17 NPAT of $20 to 23m and EBITDA of around $50m. Based upon FY16 interest and debt levels this equates to EBITDA interest cover of 5.2x and leverage (net debt to EBITDA) of 1.2x. We believe that on an underlying basis these credit metrics are solid.

However, the group faces uncertainty regarding potential regulation changes and two class actions. The class actions refer to total amounts of $17m and $30m. If these as well as the $12.5m ASIC provision were taken into account, we calculate leverage would increase to 2.5x based on the above figures (all other variables held constant). While considered an ‘intermediate’ level of leverage, it is still manageable.

Relative value

The following table details the trading margin for high yield financial peers.

Source: FIIG Securities

Source: FIIG Securities

In our opinion, CCV, with a relatively short maturity and high margin appears to offer fair value given the uncertainties discussed above. CCV 19 September 2018 fixed rate note is indicatively available at a yield to worst* of 6.28% and is available to wholesale and retail investors.

The group’s full results can be found here.

*In this instance, the yield to worst represents the yield to maturity.